If you’ve seen the value of your royalties checks decrease, you’re not alone! With the unfortunate drop in the price of oil, many mineral owner are starting to see their royalties checks also drop in value. This presents a number of questions for royalties owners. Many are wondering about the value of oil and gas royalties in West Virginia and where we head next from here. While the true price of oil has yet to be determined, you can bet that the rest of 2015 will bring some wild swings to the amounts you see in your royalty checks each month.

If you’re receiving oil and gas royalty checks in West Virginia, this article will serve as a guide to better help you understand the value. It wasn’t long ago when oil was at $100, price were fairly consistent, and you could rely on your royalty checks each month. In this new oil environment, all bets are off about the value of oil and gas royalties in West Virginia. However, we can help you make sense of the situation and figure how to make the best possible choices with regard to your royalties.

How oil and gas royalties in West Virginia are calculated

To understand the value of oil and gas royalties in West Virginia, you first need to understand where your royalties are coming from. In the most basic sense, the royalty checks you receive are based on two things. 1) The amount of produced oil and gas 2) The price of oil and gas

There are a lot of other factors at play such as your royalty percentage, the amount of net acres owned, deductions, one time expenses, and the actual amount paid to an operator. However, the main thing driving your royalty checks are the production and price of oil and gas. What does this mean for you? It means that if either of these two factors changes substantially one direction or the other, it will have a significant impact on the amount you receive each month for royalties in West Virginia.

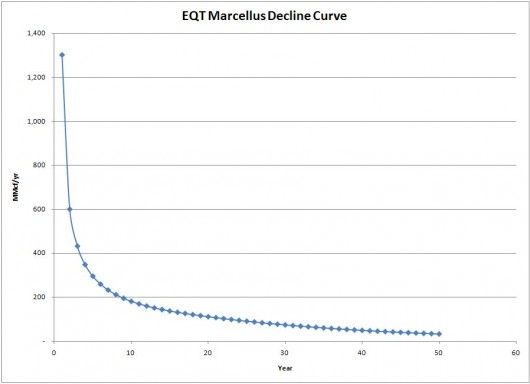

The production of an oil and gas well stays generally consistent. However, if you look at the graph below it shows you what the average Marcellus Shale oil and gas well looks like. Generally the production is very high in the first 1 to 3 years and then quickly drops off and settles at a lower rate. It will then decline over time until it eventually isn’t economic to produce. If you’re seeing a quickly decline in production, it’s likely that you just started receiving royalties in the last 1 to 3 years. However, if you have been receiving royalties for some time and they are just now starting decline, oil prices are likely the reason.

With oil prices continuing to drag on the market, the main driver behind lower royalty checks in West Virginia is oil pricing. Just 6 months ago oil prices were over $100 a barrel and West Virginia royalty owners were getting much higher royalty checks. The quick decline in the price of oil to less than $50/barrel is starting to take a toll on royalty owners. As the price of oil has declined, royalty checks are also declining since the value of the production is now worth less.

How to Value West Virginia Royalties

If you own royalties in West Virginia, you may be curious about how much your royalties are worth. While you won’t know the true value of royalties in West Virginia unless you sell royalties, it is possible to make an estimate of the value. When you sell royalties through a trust company like US Mineral Exchange, you will see what buyers are willing to pay in today’s market. However, it’s important to get a rough idea of how much royalties in West Virginia are worth before selling.

To estimate the value of oil and gas royalties in West Virginia, fill out the average amount you receive each month in the royalty calculator below. It’s tempting to look 6 to 12 months back and take the average over that time, but with falling oil prices it would be more accurate to look at the last 3 months of checks. Let’s say that over the last 3 months you have received and average of $1,000 per month. You could expect to receive anywhere from $48,000 to $72,000 for selling royalties in West Virginia. Use this calculator to estimate the value of your royalties:

Best way to Sell Royalties in West Virginia

If you’re thinking about selling royalties in West Virginia, it’s important that you sell them for the highest possible price. Especially when you consider oil prices today, you want to get maximum value when you sell. The best way to accomplish that is to allow lots of buyers to compete for your property. As buyers compete for your property, it will drive the price higher which means you get the best deal.

This is why we recommend you sell royalties in West Virginia with US Mineral Exchange. They help royalty owners get the highest possible value for selling by working with a huge network of buyers. These buyers all place competing bids against one another which drives up price ensuring you get fair market value. If you are thinking about selling, we wouldn’t hesitate to use their service.

Free Consultation

If you own mineral rights and have questions, fill out the free consultation form below. We can help you with the following questions:

- Mineral Rights Value

- Evaluate whether you have a fair offer to sell mineral rights

- Answer questions about selling mineral rights

- Understanding Market Value of Mineral Rights

- + Any other questions related to mineral rights!

No matter what question you have regarding your mineral rights, we can help! We usually respond to your inquiry within 1 to 2 hours!

Whether you want to sell mineral rights, determine mineral rights value, or simply have some basic questions regarding your mineral rights ownership, fill out the form and we will quickly be in touch.